TripLog/1040

iPhone • iPad • iPod Touch |

The software that pays for itself! Keep track of all your deductible (or reimbursable) mileage and lower your taxes!

In the United States, you can deduct mileage travelled in your car on your income tax return in a number of categories:

- Business travel (not including commuting to and from a regular office)

- Travel in the course of volunteering for any 501c(3) charitable organization

- Travel incurred as part of deductible medical expenses (e.g., driving to a doctor's office, driving to a pharmacy to pick up a prescription)

- Relocation travel

TripLog lets you track each of these categories separately (medical and relocation are grouped together), because the IRS deduction for each of them is different (in 2008, for example, the deduction was 50.5 cents per mile for business miles driven for the first six months of the year and 58.5 cents per mile for the last six months of the year, 19 cents per mile driven for medical or relocation purposes for the first six months and 27 cents per mile for the last six months, and 14 cents per mile driven in service of charitable organizations).

TripLog also lets you track mileage in a fourth category, but only those just mentioned actually become income tax deductions. Income tax returns (form 4562) have a separate line for "commuting miles," so you may wish to track those, but they don't create a deduction.

In addition to the mileage deduction, cars driven more than 50% for business purposes can also generate a Section 179 depreciation deduction for the cost of the car itself. Here again, TripLog is an essential tool providing documentation for that greater than 50% usage.

Parking fees and tolls paid in the course of driving mileage which is deductible are also deductible, and TripLog allows you to keep track of those as well.

Record the way you want to record

IRS tax forms require only that you submit a single number for the total distance travelled in various categories, and that you keep records to substantiate that information. Many accountants advise their clients to include both starting and ending odometer readings for each trip in those records, although there is no explicit requirement of that in the IRS code. TripLog lets you configure exactly what you want to record — either a single distance for each trip, or the two odometer readings.

Some people need to track their time spent with different clients or on different projects, and in such cases recording the starting and ending time for each trip (and hence the duration) becomes important. TripLog is also configurable to record that information if that's what you need.

NOTE: The information above applies to the United States; the details vary (considerably!) in other countries. But in any country, whatever the tax laws, TripLog will still prove invaluable if you are being reimbursed by your company for miles driven in the course of business. Don't let poor recordkeeping keep you from getting reimbursed what you are owed!

Here's a summary of the features you'll find in TripLog:

- Track mileage in four categories (business, charity, medical, and "other" by default; user-configurable) for three different cars

- Record a date, distance, category, destination and, optionally, purpose for each trip, as well as tolls and parking when applicable

- Record either trip distance or start/finish odometer readings (software treats distance simply as numbers, so you can record either miles or kilometers, as appropriate)

- Optionally record start/end time for each trip; software automatically calculates and records trip duration as well

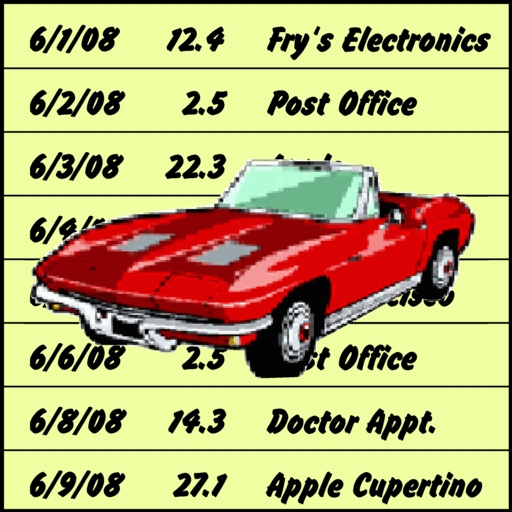

- Immediate (same screen) view of three most recent entries to see whether you entered yesterday's trip, and to confirm correct entry of the current trip; full scrolling view of recorded trips on separate screen

- Save "frequent trips" for one-tap data entry. "Frequent trips" can include any a destination, a purpose, and/or a distance so you can enter as much information as is constant from trip to trip with a single tap

- Quickly add up total mileage for different time periods (e.g., year-to-date, last week), subtotaled for different cars and categories

- Email your entire log or portions of it (by date) to yourself or your accountant for tax records, or to your company for reimbursement

- Upload your entire log or portions of it to your desktop using Apple's iTunes file sharing

- Full localization in multiple languages (not including the manual): French, Spanish, Portuguese, Dutch, German, Swedish, Norwegian, and Finnish.

- Data output via either email or file sharing is sent as simple text files, customizable as to field separator (tab or comma), line separator (CR, LF, or CRLF), and encoding (ASCII/UTF-8, Unicode-16, MacOS Roman, or Windows Latin), as well as with optional inclusion of totals, for maximum compatibility with desktop software (spreadsheet, database, or wordprocessing software).

- Runs on iPhone, iPod Touch, and iPad (not optimized for larger iPad screen). Full support for multitasking with iOS 4.0 or higher.

Disclaimer!

TripLog/1040 is a tool for recording mileage. It does not offer tax advice. If you want to understand the possible value of mileage deductions on your income taxes, or the rules and limitations which govern them, please discuss these issues with your accountant and/or lawyer. Stevens Creek Software makes no claim for this software other than that you can use it to keep a record of your mileage.

Want to learn more?

- Watch a movie showing the software in action here

- Read the complete manual here

- Read about our other software for iPhone, PalmOS, Mac, and Windows here

About Stevens Creek Software:

Stevens Creek Software has been developing software for Windows, Macintosh, Palm, and iPhone since 1988. We have been a leading developer of software for the Palm platform, and are now one of the leading developers of software for iPhone, with eight different titles on the market.

Stevens Creek Software

P.O. Box 2126

Cupertino, CA 95015

Click "Recommend" to let your Facebook friends know about TripLog/1040: